what does liquidating stock mean

They are intended to. To liquidate means to sell an asset for cash.

Meaning Of Liquidation Reasons For Liquidation And Calculation Of Liquidator S Remuneration The Accounting Brain

If a companys market capitalization what its worth is a pie.

. A liquidation specialist at a brokerage firm can help you anticipate the tax consequences when you liquidate stock and advise you about an approach that will maximize. Once the insolvent company has gone into liquidation the insolvency practitioners primary task is to pay creditors what they are owed from any monies realised. Cash is the most common liquid asset because it can freely flow to wherever the business needs it.

To make it usable stockholders need to sell it ie liquidate it to lock in its value. What Does Liquidation Mean. Businesses can liquidate their assets for any number of reasons but.

The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just try paying for lunch with a share of Johnson Johnson. This means if bitcoins price falls so too does the amount of funds held in collateral resulting in faster liquidations. A stock liquidation occurs when stock shares are converted into cash.

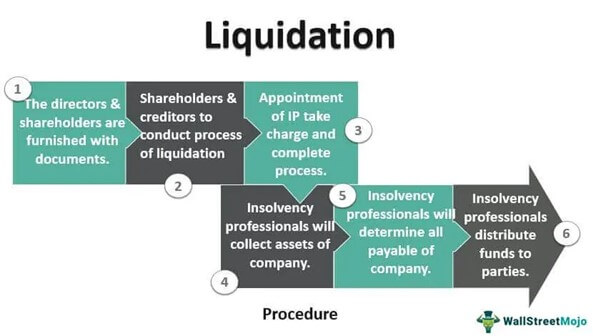

To liquidate your stock portfolio means to sell this portfolio for money. In the context of cryptocurrency markets liquidation refers to when an exchange forcefully closes a traders leveraged position due to a. Liquidation is the process of selling off assets to repay creditors and distributing the remaining assets to the owners.

Liquidating a stock means selling it for cash. What Does the GME Stock Split Mean for Investors. A liquidation that takes place when both the buyers and the sellers of the assets perform the transaction voluntarily.

For example you may be taxed on capital gains or lose the portfolios future appreciation. What Does FUD Mean in the Stock Market. What does liquidating your assets mean.

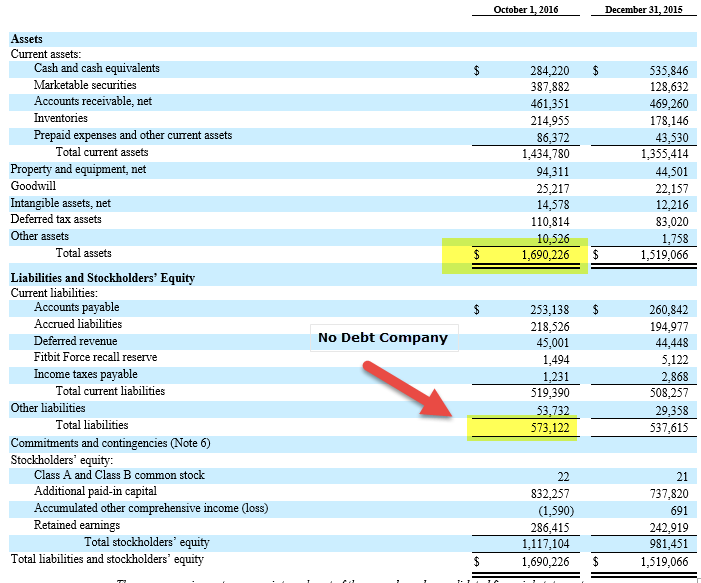

Both fixed and current assets are considerations when determining a companys liquidation value. The remaining assets are also called liquidation proceeds. In most instances stock liquidation occurs when shareholders sell their shares on the open market for ready cash.

Investors may choose to liquidate an investment for a variety of reasons including needing the cash wanting to get out of a weak investment or. What Does Liquidation Mean for Company Shareholders. Whenever you liquidate a small portfolio or convert the stock to cash it has financial consequences.

Liquidating a house for example would mean turning the house into cash - in other words selling it. In the case of a company a voluntary liquidation takes place when the company leadership decides to dissolve the company also referred to as winding-up the company and obtains shareholder approval if needed. Liquidate the existing stock means to get rid of everything or to mark down the prices of everything in stock Financial assets which can be spent are known as liquid.

It could be stocks crypto or other investment products. Liquidating a stock means selling it for cash. What is Preferred Stock.

The liquidation level normally expressed as a percentage is the point that if reached will initiate the automatic closure of existing positions. Very simply a stock split can be thought of as making more slices of a pizza. When you decide to liquidate your assets you are selling those specific assets in exchange for cash or cash equivalents.

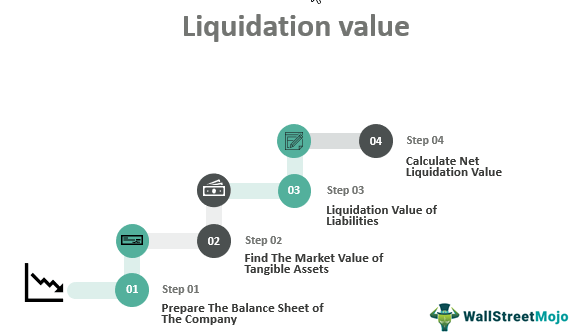

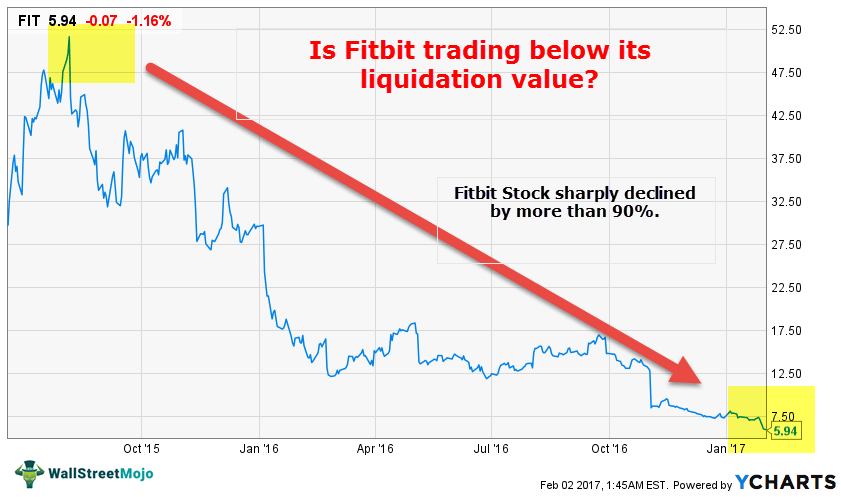

Its different than trading these assets on the spot market because. When someone says liquidation value they simply mean the total value of the tangible assets of a company when the company ends. Many companies offer different classes of ownership including preferred stock.

You dont actually own the asset in the hope that it will increase in value. Whenever you liquidate a small portfolio or convert the stock to cash it has financial consequences. What does it mean when a stock is liquidating.

Liquidate means converting property or assets into cash or cash equivalents by selling them on the open market. The ideal way for stock to get liquidated is. But it almost always is used when referencing high-risk volatile trending investments.

Liquidation in economic parlance means turning things into money. Liquidation means the distributions of the Trust Account to the Public Shareholders in connection with the redemption of Ordinary Shares held by the Public Shareholders pursuant to the terms of the Companys Amended and Restated Memorandum and Articles of Association as amended if the Company fails to consummate a Business Combination. Liquidation similarly refers to the process of bringing a business to.

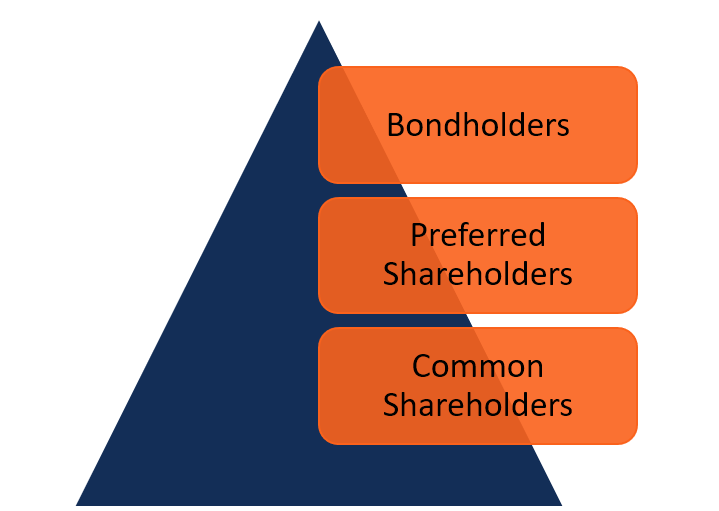

Shareholders will receive nothing until the creditors have been paid and there is no law requiring the liquidator to keep them informed on the progress or outcome. Liquidation sale discounts start at. FUD is commonly referred to as a barrier or concern related to a particular investment.

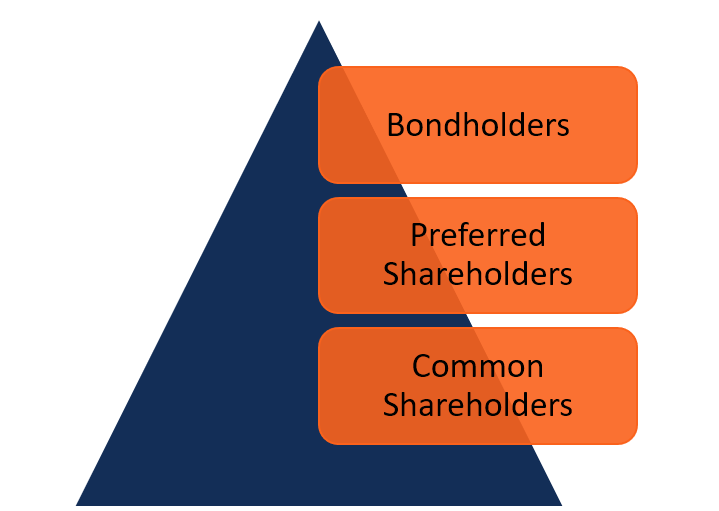

An important factor to remember is that owners of preferred stock must be the first paid upon liquidation of a company. Due to the risk associated with leverage trading some exchanges have. A liquidation sale is a sale held by a company going out of business in an attempt to get rid of its remaining stock and assets.

One reason for stock liquidation is if a company files for bankruptcy. In a business and legal context liquidation which comes from the Latin liquidaries or liquefaction means the sale of all of a companys assets with the end result being that the company is terminated. In other words liquidation is the process of closing a business paying off creditors and giving the investors whatever is left over.

Trading perpetual futures contracts for Bitcoin or Ethereum is a special way in which you can engage crypto assets. Stock liquidation which refers to selling stock in a company in exchange for money is something that occurs for various reasons.

Chapter 7 Bankruptcy Liquidation Video Khan Academy

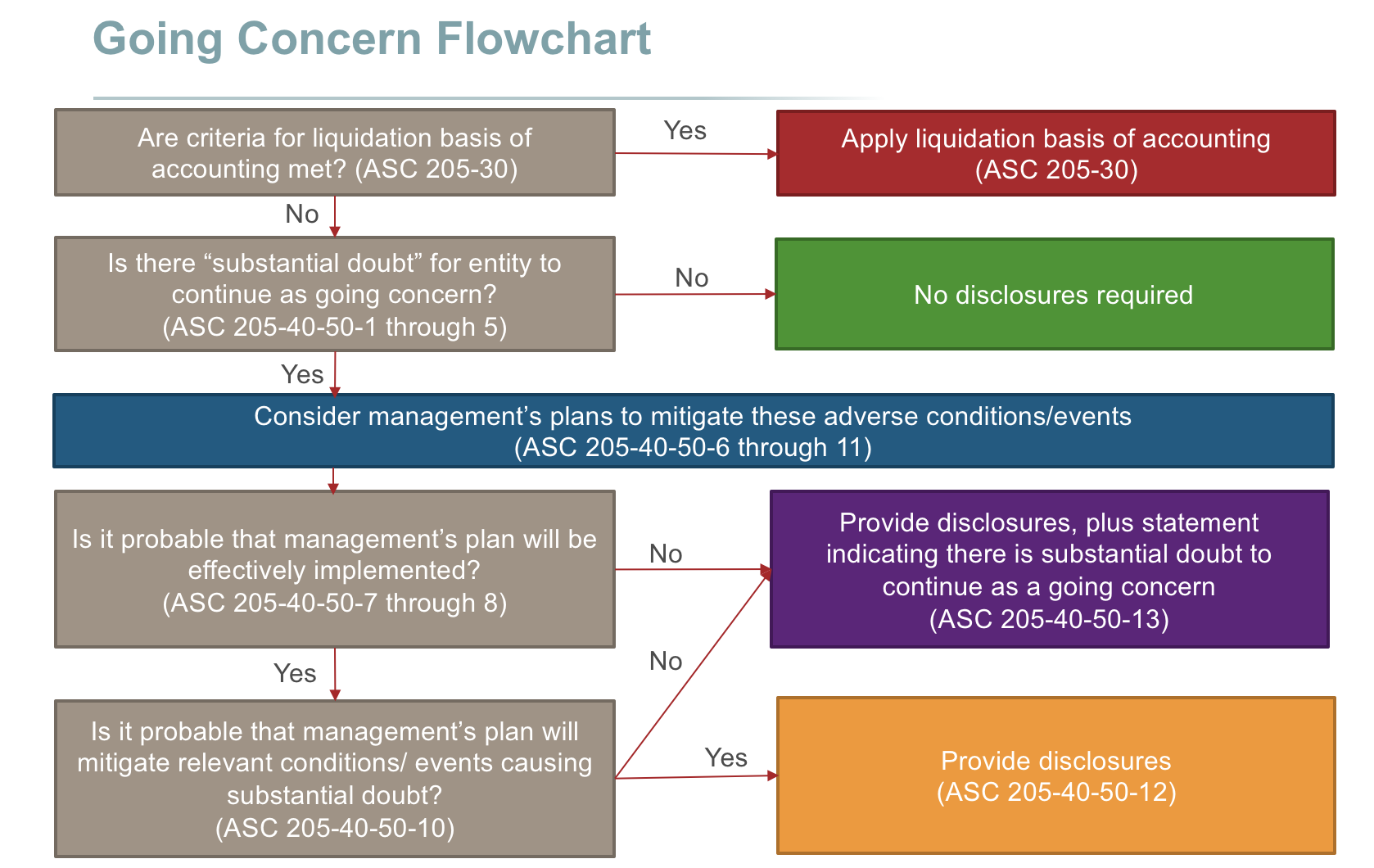

Let S Refresh The Liquidation Basis Of Accounting Gaap Dynamics

Liquidation How It Works And When To Close Down Company Debt

How To Estimate The Size Of Liquidation Merchandise B Stock Solutions

Liquidation Meaning Process Types Examples Consequences

Liquidation Value Formula Example Step By Step Calculation

Liquidation Value Formula Example Step By Step Calculation

Small Business Liquidation What Is Liquidation In Business

Liquidation Value Formula Example Step By Step Calculation

Preferred Shares Types Features Classification Of Shares

Net Asset Liquidation Definition Types And Examples

Liquidating Amazon Inventory 8 Ways To Sell Off Your Stock

/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)

Cash Liquidation Distribution Overview

How To Buy Liquidation Merchandise B Stock Solutions

Let S Refresh The Liquidation Basis Of Accounting Gaap Dynamics

/GettyImages-1005470094-d3c3108c195f40f3a1244331105e18f5.jpg)

/liquidation-d53884bd0c01485ba4e6d20385228aa7.jpg)